Introduction

On November 15, 2023, the Centers for Medicare and Medicaid Services (CMS) published a proposed rule that would revise the Medicare Advantage Program. This proposed rule includes new policies that would improve the program, beginning with contract year 2025, and proposes to codify existing Part C and Part D sub-regulatory guidance. The impacts of the proposed rule include but are not limited to: implementing guardrails for plan compensation to agents and brokers, improving access to behavioral health care provider, and proposing new standards and mid-year enrollee notifications for supplemental benefits. In this month’s blog, we take a deeper dive on the section of the proposed rule addressing the MA RADV Appeals Process. While leaving the overall framework in place, the proposal simplifies the RADV appeals process for CMS and Medicare Advantage organizations (MAOs), addressing timeline and workflow ambiguities in the current regulation. We will provide a refresher on the current RADV appeals process, summarize the proposed changes, and provide insights on how these changes will affect MAOs moving forward.

Current RADV Appeals Process

Under the Risk Adjustment Data Validation (RADV) program, MAOs are required to submit medical record documentation to CMS supporting diagnoses submitted for risk-adjusted payment. As part of the audit process, MAOs may contest CMS’s findings in the administrative appeals process as outlined in § 422.311.

At the conclusion of a plan’s medical record review, CMS issues an audit report containing the following:

- enrollee-level information,

- validated and discrepant audited HCCs,

- non-audited HCCs identified in the medical record review,

- sample payment error estimate,

- extrapolated contract-level payment error estimate,

- approximate timeline for the payment adjustment,

- and a description of the MAO’s RADV audit appeal rights.

If an MAO disagrees with a medical record review and/or the payment error estimate calculation, it must file a written request within 60 days of issuance of the RADV audit report. Under the regulation, the scope of the appeal is limited to medical record review determinations (MRRD) and/or the RADV payment error calculation (PEC). Furthermore, any methodology, including the RADV Sampling methodology, Medical Record Review (MRR) methodology, and the RADV PEC methodology, may not be appealed. After defining the specific findings under challenge, the plans bear the burden of proof of showing by a preponderance of evidence that an MRR or calculation was incorrect. The MAO is not allowed to include additional HCCs, medical records, or other documents beyond what had been submitted to CMS during the audit (RADV-reviewed medical records and any accompanying attestations).

In an MRRD appeal, CMS conducts a new review on the medical record put forward by the plan to support the appealed HCC. The plan must provide the location in the record and an argument supporting the presence of the appealed HCC. It is important to note that for each appealed HCC, only one record can be put forward and that record must have been submitted during the audit submission window. For the PEC appeal, this appeal is limited to challenging the arithmetic in the audit report notification.

Under the regulation, for each appeal type, plans are availed three levels of review as follows:

- Reconsideration (Stage 1)

- Hearing Officer Review (Stage 2)

- CMS Administrator Review (Stage 3)

If an MAO disagrees with a finding at one level of review, they may escalate their argument to the next level. After adjudication of the appeal at each level, a new audit report is issued reflecting any adjustments made to the original finding for either the MRRD reconsideration or the PEC calculation.

In reconsideration, for MRRD, CMS performs a new review on the appealed medical record using the information provided by the plan to find support for the discrepant HCC. For PEC, CMS will request a third-party who was not involved in the initial RADV PEC calculation to recalculate the payment error. If CMS’s original finding is upheld, within 60 days of receipt of the reconsideration decision, the MAO may escalate to Stage 2.

In Stage 2, The CMS hearing officer reviews the materials produced and submitted in Stage 1, including the MAO’s written brief and the reconsideration official’s written response brief. The hearing officer has full authority to make rules and establish procedures, consistent with the law, regulations, and the HHS Secretary ruling. If either CMS or the plan disagree with the Stage 2 decision, they may escalate to Stage 3.

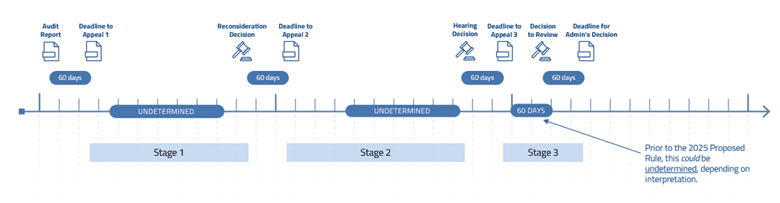

In Stage 3, the CMS Administrator reviews Stage 2’s hearing record and written arguments from the MAOs and/or CMS. The CMS Administrator has the discretion to accept or decline to review the hearing officer’s decision. If the administrator reviews the hearing officer’s determination, the administrator can uphold, reverse, or modify the decision. If the administrator declines to hear the appeal, the Stage 2 appeal finding stands. The timeline for all three appeals can be seen below in Figure 1. Please note that under the current regulation, there is no time limit for the CMS Administrator electing to review a Stage 2 finding.

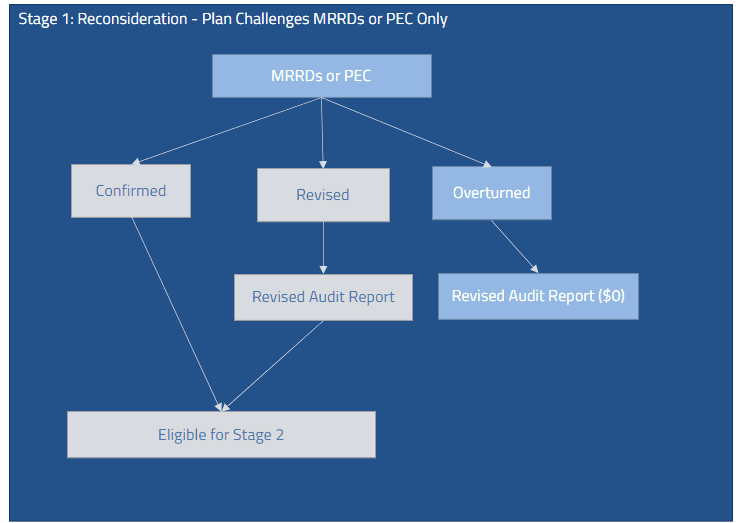

The proposed rule also clarifies the ordering of the MRRD and PEC appeals, a point of contention with the process today. Under the current regulation, plans have the discretion to submit either a PEC or an MRRD appeal singularly or together in reconsideration. In the case where a plan submits either an MRRD appeal or PEC, as shown in Figure 2, the process is straightforward. At the conclusion of reconsideration, there are three possible outcomes: confirmed, revised, or overturned. A confirmed finding signifies that the original medical record review or PEC finding was determined to be correct. A revised finding indicates that in the MRRD, an appealed HCC was re-determined in a hierarchy and/or additional HCCs were confirmed in the new medical record review. An overturned finding indicates the original HCC discrepancy is now supported. A revised or overturned finding would trigger the re-issue of an updated audit report. Except for CMS also being able to appeal the hearing officer’s decision, Stage 2 and Stage 3 appeals follow similar workflows.

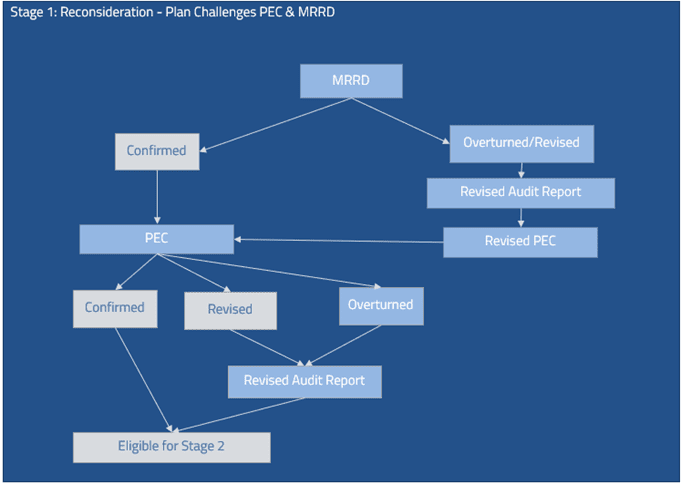

Under the current regulation, in addition to submitting one or the other in reconsideration, a plan can submit both an MRRD and PEC appeal. This scenario surfaces regulatory ambiguity and operational challenges for CMS and the plan. While not stated in the regulation, because the PEC appeal is dependent on the MRRD finding, we assume the MRRD appeal would be adjudicated first. As shown in Figure 3, when the MRRD finding is confirmed, the process is straightforward and similar to the MRRD/PEC only process. However, in the case where the MRRD finding is overturned or revised, when CMS issues the revised audit report, the plan would have to modify their PEC appeal reflecting the new findings at each stage.

Proposed RADV Appeals Process – Key Proposals

In the 2025 proposed rule, CMS clarifies and streamlines the RADV Audit Appeals process. CMS addresses the following operational limitations and ambiguity in the current regulation:

- CMS has proposed that MAOs must exhaust all levels of MRRD appeal before beginning a PEC appeal. MAOs may still submit an MRRD appeal and PEC appeal, but they do not submit both types of appeals at the same time. Because the PEC appeal is limited to challenging the calculation’s arithmetic, the interim payment error calculations throughout the appeals process become moot if revisions are made based on MRRD appeal decisions at a later stage. MAOs may only request a PEC appeal after the adjudication of the last stage of MRRD appeal.

- CMS also clarifies that MAOs that wish to submit an MRRD appeal request must specify any and all HCCs in a singular MRRD appeal request.

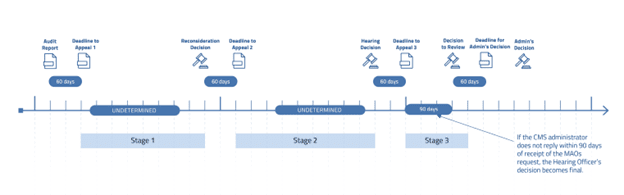

- CMS adds a requirement that the CMS Administrator must decide to review a Stage 3 appeal within 90 days of the request. If the review request has not been accepted within the time frame or is declined, the hearing officer’s decision becomes final. The updated timeline can be seen in Figure 4.

- MAOs and CMS must submit their arguments within 15 days of the date of notification that the CMS Administrator has elected to review.

RaLytics Insights

We believe these changes, if finalized, will streamline the RADV appeals process, speed up the timeline, and provide additional clarity and transparency for MAOs. The proposed constraint on the CMS Administrator’s deliberation to accept a Stage 3 appeal will likely increase the number of appeals which conclude at Stage 2, making the CMS Hearing Officer’s determination final. This has the potential to accelerate the plans’ access to relief in court. However, this also means plans may see CMS recovery and payment adjustments sooner, given CMS executes recovery at the conclusion of an MAO’s appeal.

RaLytics’ experts have extensive experience with CMS and OIG RADV audits, including drafting the current RADV and appeals regulations. MAOs should contact RaLytics for a mock RADV audit to gain insights on their audit risks and preparation for appeals. Please contact us at info@ralytics.com for more information.